On November 15 President Biden signed the Infrastructure Investment and Jobs Act IIJA a 12 trillion infrastructure bill that makes generational investments for rebuilding the nations roads bridges and rails. It operates through the following segments.

Keppel Infrastructure Trust Pandemic Proof

Mr Chiang joined Keppel Capital in 2019 as Senior Vice President Investments.

Keppel infrastructure trust investing. The firm provides investors with the opportunity to invest in a large and well-diversified portfolio of core infrastructure assets located in jurisdictions with well-developed legal frameworks that support infrastructure investment. Currently it pays 00093 a quarter. About Keppel Infrastructure Trust KIT is an infrastructure-focused business trust listed on the Singapore Exchange.

The Company offers the opportunity to invest in a diverse portfolio of core infrastructure businesses ranging from waste treatment water production power production and transmission piped gas production retailing to telecommunications. Keppel corporation sembcorp stocks. Keppel Infrastructure Trust is a business trust.

The Companys principal objective is to invest in the infrastructure assets and to provide unitholders with distributions. Keppel Capital Holdings the asset management arm of Singapore-based conglomerate Keppel Corporation has secured a 100 million commitment and a co-investment sleeve of up to 50 million from the Asian Infrastructure Investment Bank raising 570 million for its Asia infrastructure fund and co-investment vehicles. Keppel Infrastructure Trust is a listed business trust.

Keppel Infrastructure Trust is structured as a Business Trust. Keppel Infrastructure Trust reported loss attributable to unitholders of S795m in 2H20 and S344m in FY20. Keppel Infrastructure Trust is a real estate investment trust that holds infrastructure properties in Singapore Australia and New Zealand.

Distribution Network Waste and Water Energy. Keppel infrastructure trust was formed through the merger of two utility-like companies Cityspring Trust and K-Green trust. Keppel Infrastructure Trust engages in the provision of industrial and infrastructure businesses.

Keppel Infrastructure Trust is a listed business trust. He has over a decade of experience across infrastructure investing and investment banking with US10 billion of transaction and advisory experience in developed and emerging markets of Asia-Pacific Europe and North America. Keppel Infrastructure Trust engages in the provision of industrial and infrastructure businesses.

Accessing the larger investor base of Keppel Capital Holdings Pte. KC in further diversifying the sources of financing for KIT and its underlying businesses including for co-investments bridge financing and other types of senior and mezzanine financing. Distribution Network Waste and Water Energy.

Keppel Infrastructure Trust is a business trust. Cityspring turned out to be 50 leveraged and didnt performed as what retail investors thinks it should. It operates through the following segments.

KEPPEL INFRASTRUCTURE TRUST KIT offers an attractive investment proposition. Mr Thomas Pang is the Chief Executive Officer and Executive Director of Keppel Telecommunications Transportation Ltd a position he has held since July 2014. With a net asset value of SGD 149 billion as at the end of December the company aims to deliver value to its unit holders through a two-pronged strategy of recurring distributions and capital appreciation over the long term.

It also gives a good dividend. The one-off items included. Keppel Infrastructure Trust - Stable Dividend Is The Key Unique Selling Proposition.

Keppel Infrastructure Trust KIT is the merger of K-Green and Cityspring in the past. Ltd as Trustee-Manager the Trustee-Manager for Keppel Infrastructure Trust KIT is committed to disclose material information in a timely transparent and accurate manner to the public in accordance with the listing rules of the Singapore Exchange Securities Trading Limited SGX-ST the Singapore Code of Corporate. More than 567 billion in funding will go toward projects and programs that affect every aspect of.

Suvro SARKAR - Keppel Infrastructure Trust - More Debt Headroom To Pursue MA. This works out to be 75 dividend yield based on the traded price of 0495. KIT is the largest diversified business trust listed on the Singapore Exchange.

And Sharing of best practices and enhancing talent recruitment and retention. Keppel Infrastructure Fund Management Pte. However excluding the impact of one-off items amounting to S937m recognised in 2H20 core net profit would have amounted to S142m in 2H20 and S593m in FY20 a significantly better performance than FY19.

A listed infrastructure business trust with potential for long-term capital growth. Prior to that from June 2010 to June 2014 he was Chief Executive Officer of Keppel Infrastructure Fund Management Pte. Distribution Network Waste and Water Energy.

Keppel Infrastructure Trust company facts information and financial ratios from MarketWatch. Keppel Infrastructure Trust engages in the provision of industrial and infrastructure businesses. Ltd the trustee-manager of Keppel Infrastructure Trust KIT.

June 1 2020 Tom K Dear readers Sembcorp Industries stock saw much selling on 29 May 2020. The firm provides investors with the opportunity to invest in a large and well-diversified portfolio of core infrastructure assets located in. K-Green is very clean no debt but its assets are concession based and the highest contributing had a concession of 10 years.

It operates through the following segments.

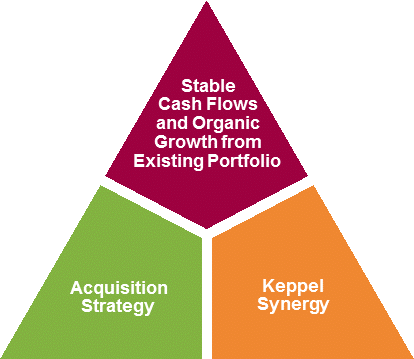

Strategy Keppel Infrastructure Trust

No comments