Cuscaden Peak appears victorious in the bidding war over SPH entering an implementation deal after the consortiums sweetened S240 cash-and-share bid beat Keppel Corps S2351 final offer. -- raised its offer to buy Singapore Press Holdings Ltd.

Brief Singapore Keppel Material Impairments May Mean A Mac Mess And More Smartkarma

PROPOSED SCHEME OF ARRANGEMENT INVOLVING SINGAPORE PRESS HOLDINGS LIMITED DEALING DISCLOSURE Keppel REIT Management.

Keppel corp notes issuance. Keppel Infrastructure Trust has announced a 5-year senior bond offering. BN4 Failure to break the gap resistance zone in October caused the price to fall sharply. Issue of S150000000 207 Notes due 2028 Keppel REIT Management.

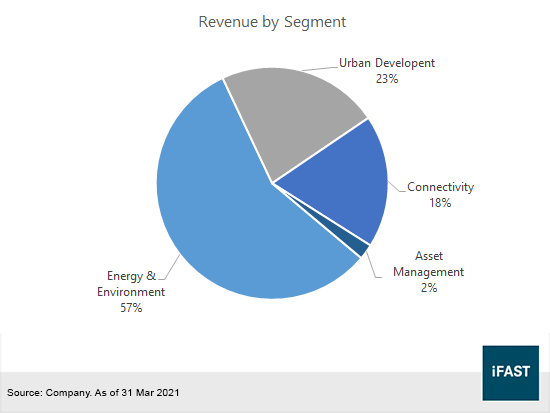

The notes were issued under its US5 billion multi-currency medium-term note program Keppel said in a filing to SGX. The Notes will be issued under the US5000000000 multi-currency medium term note programme. FY19 revenue for Offshore Marine was 29 so if we simplistically assume OM is 20 of the current market cap that puts its valuation at about 18 billion.

In April 2011 Keppel Corporation offered a 10 bonus issue. They will be issued under Keppel Corps US5 billion multi-currency medium-term note programme. Issuance of Notes under Keppel Corporation Limiteds US5000000000 Multi-Currency MTN Programme.

S539 - Technical BUY Buy spot. 138 Report to Shareholders 2019 Keppel Corporation Limited FINANCIAL REPORT NOTES TO THE FINANCIAL STATEMENTS For the financial year ended 31 December 2019 These notes form an integral part of and should be read in conjunction with the accompanying financial statements. Net proceeds will be used for general corporate or working capital purposesKeppel Corporation has priced the issue of its 42471m US300m 2459 notes due 2025 an SGX filing revealed.

Recent technical indicates that the stock is poised for a bullish rally. BN4 has been consolidating since January 2021 despite a breakout of the pennantsymmetrical triangle. Presentation Slides for SGX-Credit Suisse Real Estate Day 27 September 2021 Keppel DC REIT.

Keppel has a market cap of 93 billion. General AnnouncementIssuance of Notes under Keppel Corporation Limiteds US5000000000 Multi-Currency MTN Programme. The transaction between M1 and Keppel DC REIT is subjected to approvals and are expected to be completed by end of 2021.

DBS Bank has been appointed as the sole lead manager of the notes. We think that the new notes are fairly priced at its initial price guidance of 3125. ISSUANCE OF NOTES UNDER KEPPEL CORPORATION LIMITEDS US5000000000 MULTI-CURRENCY MTN PROGRAMME Announcement Reference SG200604OTHRB876 Submitted By Co Ind.

KEPPEL Corporation has priced S250 million worth of five-year notes at 225 per cent per annum. Keppel prices 8 billion yen notes due 2027 Jardine Matheson. Asset Acquisitions and DisposalsDivestment of Data Centre in Frankfurt.

You can see the 5-year price chart below. We covered this a few weeks back but long story short Temasek offered to buy a majority stake in Keppel for 735 but they dropped the offer after COVID-19 causing a big sell-off in the stock price. General AnnouncementIssuance of Notes under Keppel Corporation Limiteds US5000000000 Multi-Currency MTN Programme.

Keppel Corp SG. Keppel Corporations American Depository Receipts ADR Programme was launched in 1990 with a registered size of 100 million American depository shares with the Securities Exchange Commission. Oversea-Chinese Banking Corporation Limited has been appointed as the sole dealer of the Notes.

Keppel Corp Ltd Current Price. General Announcement. The S150 million notes will bear interest at a fixed rate of 3 per cent per year payable semi-annually in arrear and have a tenor of five years.

The offer is the latest twist. The offer of S2351 per share includes additional cash of S020 per share and is final according to a statement filed on the Singapore Exchange late Tuesday. The notes are payable semi-annually in arrear and have a tenor of five 5 years.

24 Sep 2021 SGXNET. It has since been updated to include more details. That means Keppel OM is slightly smaller than Sembcorp Marine pre-rights issue.

24 Sep 2021 SGXNET. The company had on Monday morning increased the limit of the programme from US3 billion to US5 billion. But the positive outlook is because the price managed to.

The first signal of a bullish upside is on 14 th October 2021 when prices broke out of the smaller range box between August 2021 to October 2021. Keppel Corporation Limited has priced the issue of S200000000 300 Per Cent. Name Caroline ChangKenny Lee Designation Company Secretaries Description Please provide a detailed description of the event in the box below ISSUANCE OF US300000000 2459 PER.

505 Take profit 1. This item was originally published on Monday 15 November 2021 at 953 am. Keppel Corp -- which is linked to Temasek Holdings Pte.

New ADRs were issued in the ratio of one ADR for every 10 ADRs held as at 28 April 2011. Then COVID-19 happened and Temasek pulled their takeover offer for Keppel. We think that the new notes are fairly priced at its initial price guidance of 3125.

The notes are under the firms 708b US5b multi-currency medium term note programmeDaiwa Capital Markets Singapore Limited and Oversea-Chinese Banking Corporation Limited have been appointed as the. The notes are expected to be issued on or about April 20 2020 and are expected to be listed on the Singapore bourse on or about the following business day after the issuance. Asset Acquisitions and DisposalsDivestment of Data Centre in Frankfurt.

Finance Economy Headlines The Wire Top Stories Keppel Corporation has priced the issue of 250m notes due 2025 bearing interest at a fixed rate of 225 per annum a local bourse filing revealed. The apparent winning bid which values SPH at S39 billion. 600 Take profit 2.

Keppel Corporation Limited Announces Pricing of JPY 8000000000 099 Per Cent Notes D. ASSET ACQUISITIONS AND DISPOSALS. The strong bullish candle was confirmed on the following.

Issuance of notes under keppel corporation limiteds us5000000000 multi-currency mtn programme 2020-04-20 175745 General Announcement Debt - Listing Confirmation. Keppel Infrastructure Trust has announced a 5-year senior bond offering. Bloomberg PSR Keppel Corp SGX.

Keppel has announced monetisation of over S23bn in assets from October 2020 to July 2021 Figure 2 and have completed about half of the transaction. By 12 after a rival entered a bid. Said Wednesday it completed the issuance of its 8 billion Japanese yen 099 percent notes due 2027.

S250000000 225 Notes Due 2025.

No comments