This again is in keeping with its Vision 2030 plan to be asset-light. 2021-10-27 122000 General Announcement.

Keppel Corp Lumpy Cash Dividend Rocks

We serve the marine industry with an array of vessel solutions and services.

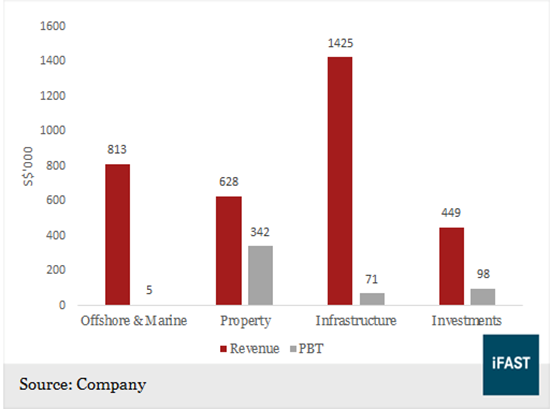

Keppel corp earnings contribution. The new signing rent psf pm for Singapore offices is higher than expiring rents in. October 28 2021. Keppel Corporation Limited Keppel reported a net profit of S515 million for the nine months ended 30 September 2019 with stronger contributions from the Offshore Marine Infrastructure and Investments divisions.

BN4 The blue-chip conglomerates offshore and marine OM division has signed a global framework agreement with Orsted CPH. Keppel s 1H21 pro-forma EPS would increase to S0175 from S0165 had the transaction been completed at the beginning of the year. The acquisition would also improve its pro-forma recurring-income contribution from 51 to 56 in our estimation.

We support the safe and efficient harvesting of energy sources to power ships and cities alike. Excluding impairments mainly for OM 1H20 recurring net profit of SGD393m is 57 and 54 of our and Streets FY20F. Keppel Corporations Keppel property earnings will largely come from China accounting for 60- 85 of our property trading profit forecasts for 2017-19.

Park in Sydney and Keppel Bay Tower in Singapore. The fall was largely on the back of lower contributions from its Energy Environment Urban Development and Asset Management segments offset by higher revenue from Connectivity. Full Year 2020 Keppel Corporation Ltd Earnings Presentation Singapore Jan 29 2021 Thomson StreetEvents -- Edited Transcript of Keppel Corporation Ltd earnings conference call or.

2021-10-26 122000 General Announcement. Media Release Keppel records sharp earnings growth for 3Q 9M 2021 with improvements across all business segments Singapore 28 October 2021 - Keppel Corporation Limited Keppel has today released its voluntary business update for 3Q 9M 2021. Sustainability goals the solar farm investment will also provide a steady income stream going forward.

For the year Keppels revenue tumbled 133 year-on-year to S66 billion. The deal will give Keppel access to SPHs real estate footprint which includes. Keppel Corp Ltd KEP Recommendation With its purchase of M1 Singapores third largest mobile player KEP is transforming into an even more diversified conglomerate.

The Companyâs segments include Offshore Marine OM Infrastructure Others Urban Development Connectivity Asset Management and Corporate Others. Keppel and NTU collaborate on zero-emissions decarbonisation and circular economy solutions. Excluding impairments net profit would have been S222 million for 2Q 2020 up 45 from S153 million in 2Q 2019.

However contributions from Keppel Capital grew 23 YoY to SGD64m largely due to stronger operating results and mark-to-market investment gains. Commencement of consent solicitation process by SPH and guarantee to be given by Keppel Land. Net profit for the first nine months of 2021 was a sharp reversal from the net loss registered a year ago with all segments.

Net profit for 9M 2019 was 37 lower compared to that of 9M 2018. The 9 months DPU has increased from 42 cents to 441 cents assume 3Q distribute 100 of distributable income. 9 Includes 100 contribution from the manager of Keppel DC REIT.

Keppel Corporations turnover and net profit for the third quarter grew strongly from last year thanks to higher contributions from all four key segments. Loh Chin Hua -. We estimate that profit contribution could grow from S5-10m pa to S100m pa.

Keppel Corps net profit for the first nine months of the year was a sharp reversal from the net loss recorded in the same period last year with all business segments performing better the firm said on Thurs. Assuming its 7GW target is achieved. Get the latest broker reports from Zacks Investment Research.

UPDATE 1-Conglomerate Keppel to buy Singapore Press Holdings for 17 bln. Once again we bring you a slew of corporate highlights from several REITs and a blue-chip company. We create enduring value with quality investment products and platforms.

Keppel Corporation - Sharp Impairments But Stable Recurrent Earnings. Last year Keppels attributable profit before exceptional items grew 15 over the previous years to 273m in spite of the loss of 4 months of profit contribution from Keppel Capital which we. Keppels offshore and marine OM business falls under the Energy Environment segment.

It did not disclose earnings for. 2021-10-26 082800 General Announcement. ORSTED to undertake future offshore substation OSS projects.

Singaporean conglomerate Keppel Corp said on Monday it would buy Singapore Press Holdings Ltd SPH for S224 billion 165 billion excluding the newspaper publishers media business. Keppel Corporation Limited is an investment holding and management company. OM segment includes offshore production facilities and drilling rig design construction fabrication and.

This will primarily be driven by phased project launches from Tianjin Eco-city and secondary contributions from projects in Wuxi. At end-2020 Keppel Renewable Energy entered into an agreement to acquire a 45. We green cities with.

The Groups net loss for 2Q 2020 was S697 million compared to a net profit of S153 million for 2Q 2019 due mainly to impairments and weaker performance by Keppel OM. Keppel Corporation Limited SGX. Group revenue of S1325 million for 2Q 2020 was 26 lower than the S1784 million a year ago with lower.

Keppels asset management unit saw net profits fall to SGD117m compared to SGD258m YoY in the absence of one-off gains. Keppel Corporation Limited OTCPKKPELF Q4 2020 Earnings Conference Call January 28 2021 430 AM ET. In 4Q2018 M1s reported profit before tax was SGD315mn versus KEPs profit.

Keppel Corp s recurrent earnings should gradually rise supported by growing infrastructure. 10 Includes 100 fees from subsidiary managers joint ventures and associated entities as well as share of fees based on shareholding stake in associate with which Keppel has strategic alliance. The voluntary business update also noted that revenue for the nine months to Sept 30 rose 14 per cent from a year earlier to 55 billion.

Keppel Corp SGXBN4 incurred a 1H20 net loss of SGD537m compared with 1H19s SGD256m net profit.

8 Things Bond Investors Should Know About Keppel Corp Bondsupermart

No comments