2021-03-29 074100 Annual Reports and Related Documents. The amount of funds available.

Keppel Corporation Annual Reports

10 May 2021.

Keppel capital annual report 2018. The REIT has assets under management of approximately 9 billion in Singapore key Australian cities of Sydney Melbourne and Perth as well as Seoul South. Keppel REIT is one of Asias leading real estate investment trusts REITs listed on the Singapore Exchange with a portfolio of Grade A commercial assets in key business districts pan-Asia. FY2017 Financial Results Presentation.

Presentation Slides for Keppel Capital Virtual Corporate Day 11 May 2021 Keppel Pacific Oak US REIT Management. 2018-12-27 175033 Disclosure of Interest Changes in Interest. Interest Coverage Ratio 114 times Improved from 2017s 97 times Improvement was mainly due to higher NPI in 2018.

Keppel Capital is the asset management arm of the Keppel Group. 178 higher than 2018s 961m due to new acquisitions and full year contributions from maincubes Data Centre and Keppel DC Singapore 5. 2018 Annual Report View Annual Report Download.

Keppel aims to be a powerhouse of end-to-end solutions for sustainable urbanisation an ESG leader advancing climate action as well as a valuable company with a strong growth trajectory delivering 15 ROE steady recurring income and good dividends. To a future where Puravankara is a household name. 314 above that of 2018.

MindChamps Partners Pavilion Capital To Go Global. Response To SGX Query On Annual Report For The Financial Year Ended 31 December 2017. Annual Reports and Related Documents Keppel REIT Management.

To fulfill the aspirational needs of our customers in their real estate ownership journey. Click the button below to request a report when hardcopies become available. The financial year ending 30th June 2018 saw Keppel Financial Services Limited deliver another year of growth in a tough.

01 Apr 2021 Alpha Investment Partners secures S360 million separate account mandate from Dutch pension fund manager PGGM. Where we are heading. Distribution per Unit DPU Growth 761cts 40 higher than 2018s DPU of 732 cents.

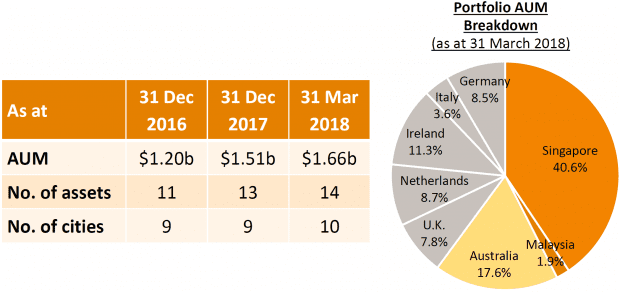

Assets Under Management4 20b 305 higher than 31 December 2017s 15b Increase was largely due to the additions of Keppel DC Singapore 5 and maincubes Data Centre. I am pleased to present Keppel DC REITs annual report for the financial year ended 31 December 2020 FY 2020. Daily revenue run rate of C 767 cr in 2018-19 Why we exist.

Keppel Corp Ltd has reached its limit for free report views. Donations and Community Capital Investments allocated for the year was 82607. Apr 16 2018.

The Company are properly drawn. MindChamps Partners Pavilion Capital To Go Global. Keppel Capital is a.

Annual Reports and Related Documents. Annual Reports Related Documents. In total earnings generated by our data centre business from 2014 to 2019 through the collaboration of Keppel Data Centres and Keppel Capital.

Notwithstanding a few divestments by Alpha Investment Partners Alpha during the year Keppel Capitals total assets under management AUM remained stable at about 29 billion as at end-2018. Leveraging the Groups extensive network and deep operational insights Keppel Capital is in a unique position to create operate and manage quality proprietary assets from energy and infrastructure to real estate. Keppel REIT 2018 Annual Report.

MindChamps Continues To Expand 3 Minds Movement In Australia. Paving the way for growth Keppel Capital announced acquisitions worth over 2 billion and seized organic and inorganic opportunities to grow our asset portfolio. We will also strive to become a stronger more disciplined and more sustainable company.

2017 Annual Report View Annual Report Download. Office Day 3 Mar. Presentation Slides for Keppel Capital Virtual Corporate Day 11 May 2021.

A total net capital employed of NOK 46 billion at the end of 2018. Keppel Pacific Oak US REIT Presentation for Phillip Securities 1 Jun 2021 Download. Keppel Capital Virtual Corporate Day 11 May 2021 Download.

Received the highest AAA rating in the Morgan Stanley Capital. 2 Funds from operations is defined as profit after tax adjusted for reduction in concessionlease receivables transaction costs non-cash interest and current cash tax. Apr 26 2018.

2 Annual Report 2018 0 20 40 60 80 100 0 200 400 600 800 1000 1200. 2 ANNUAL REPORT Fnnc Sc Lt Chairs Report 3 Branch Managers Report 4. S-REIT Corporate Day 2021.

6 Report to Unitholders 2019 Keppel REIT. 2020 was an unprecedented year with the. Keppel Capital has a 50 interest in the Manager with the remaining interest held by Keppel TT.

Completion Of Acquisition Of MindChamps PreSchool. 2018-19 2018-19 Daily sales booking of 12 units in 2018-19 - at a record high. What we are doing.

BNP Paribas Singapore REIT Day 18 May 2021 Download. Keppel will push ahead with our growth strategy harnessing Group synergies and strengths from all our businesses. Keppel REIT 2016 Annual Report.

1Q 2021 Key Business and Operational Updates Download. Total DPU for 2018 of 556 cents was based on 142 cents 142 cents 136 cents and 136 cents announced during the 1Q 2018 2Q 2018 3Q 2018 and 4Q 2018 results announcements respectively. US360m Worth of initial capital commitments received from investors of the KAIF which has a target size of US1 billion.

Notice Of Annual General Meeting. The contract was signed with Keppel Fels for a harsh environment midwater semi-submersible rig with Awilco Drilling as. Resolutions Passed At The Annual General Meeting.

2 Report to Unitholders 2019 Keppel Infrastructure Trust 1 Based on Unit closing price of 0540 and 0485 on the last trading days of 2019 and 2018 respectively. Keppel REIT 2020 Annual Report. Annual General Meeting 2021 Download.

These were partially offset by the higher Managers fees. Keppel REIT 2019 Annual Report. Aggregate Leverage 369 All-in average cost of debt was 369 per annum with interest coverage ratio at 48 times.

Independent Auditors Report to the member of Keppel Infrastructure Fund Management Pte Ltd For the financial year ended December 31 2018 Report on the Audit of the Financial Statements Our Opinion In our opinion the accompanying financial statements of Keppel Infrastructure Fund Management Pte. Resolutions Passed At The Annual General Meeting. Increase in Distribution Per Unit DPU 3121 Achieved DPU of 601 US cents in 2019 312 above 2018s adjusted DPU1 and 260 above adjusted DPU for the initial public offering IPO forecast2 respectively.

Of 542 based on the 2018 closing price of 1350. Keppel REIT 2017 Annual Report.

Keppel Corporation Annual Reports

No comments